If you’re an entrepreneur who wants to start an enterprise in the United Arab Emirates, setting up your company will be essential so that you can become compliant with your local tax laws and do business in the country without running into any legal hurdles or liabilities. Company setup UAE in the UAE isn’t easy, however, so make sure to follow these steps closely if you want to avoid any problems along the way.

Business Setup Company in UAE

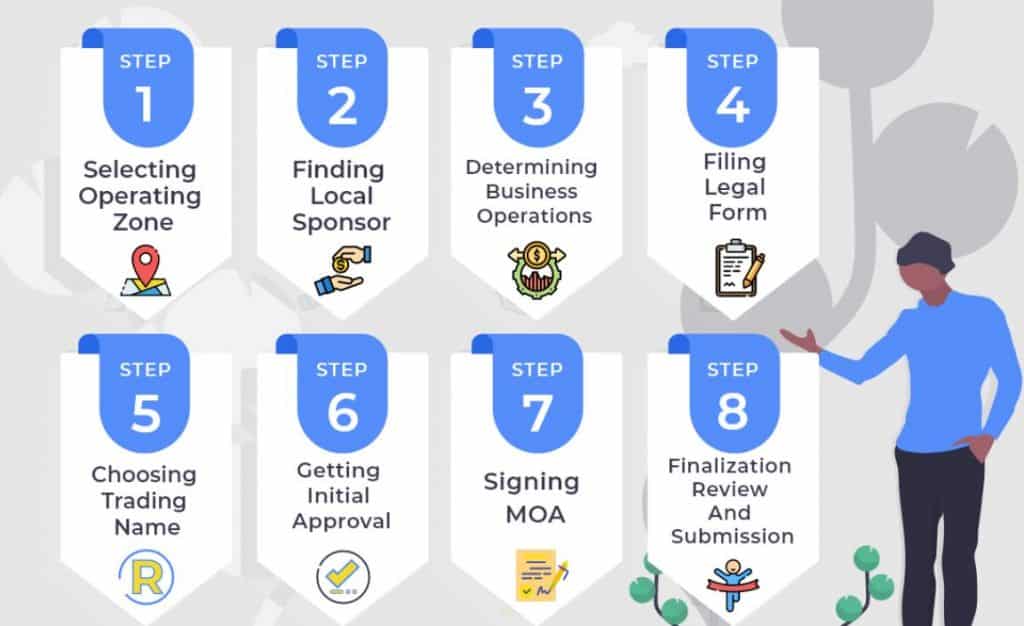

Company setup UAE is a process that requires careful planning and consideration. There are many factors to take into account, such as the type of business, the location, and the licensing requirements first step is to choose a business structure. The most common types of businesses in the UAE are sole proprietorships, limited liability companies, and civil companies. The second step is to decide on a name for your business. The name should be easily recognizable and reflect your brand.

Make sure that your business name isn’t already being used by another company setup UAE in your area or industry, and choose a name that is spelled in Arabic or Roman characters. Business setup company in UAE Second Paragraph after you’ve chosen a business structure and created a company name, you will need to register with local authorities as well as obtain specific licenses required by law. You will also need to acquire an entry visa if required before coming to live in UAE as well as after opening your new UAE Company.

How do I Setup Company in UAE?

Company setup in UAE can be a complex process, but there are a few key steps you can take to streamline the process. First, you’ll need to decide on the type of company you want to set up. Then, you’ll need to choose a name for your company setup in UAE and register it with the authorities. Once your company is registered, you’ll need to obtain the necessary licenses and permits from the UAE government.

Finally, you’ll need to open a bank account and establish a physical presence in the UAE. You can register your company in UAE by going to your local Commercial Registration Office and completing an application form. There are certain requirements that you need to fulfill before you can open a company in the UAE, such as providing proof of residence and signing a declaration that you’re not under investigation for financial crimes.

One of the most important decisions you’ll make when starting a company setup UAE and choosing its name. Once you choose your name, it cannot be changed so carefully consider what it says about your business and whether it will be easy to spell, pronounce and remember. You may also want to incorporate an official brand with distinct logos, color schemes, and taglines into your name.

Cost to Start A Company Setup in UAE?

The cost of a company set up in the UAE can vary depending on the type of business you want to establish. For a sole proprietorship, you’ll need to pay for a trade license, which costs around AED 10,000. For a limited liability company, you’ll need to pay for a trade license, registration with the Department of Economic Development, and visa fees for yourself and any employees. If you’re setting up a branch office of an existing company setup UAE, you’ll need to pay for a trade license and registration with the Department of Economic Development. These costs can range from AED 30,000 to AED 100,000.

In addition to these costs, you’ll need to pay for accounting services. This can be about AED 1,000 to AED 2,000 per month. Furthermore, business owners in UAE must pay taxes. You may need to pay up to 30% of your profit in corporate tax and 25% value-added tax. On top of that, you may also need company setup UAE to hire a lawyer to help with your business formation and registration. Companies also typically pay an annual service fee twofour 54 freezone when they renew their trade license each year; it’s usually around AED 3,000.